By Jon Reynolds

Everything you heard and read about in 2020 in the craft brewing industry claimed that it was the “Year of the Craft Brewery Pivot.” The COVID-19 pandemic shut down the on-premise sales segment and caused some craft brewers to shut their doors to the public. Others “pivoted” from mostly on-premise sales to off-premise and direct-to-consumer sales. With their taprooms struggling to remain open, due to state laws and maximum capacity limits, craft brewers shifted into high gear to land local grocery store, liquor store, and in some cases C-store business. They also began shipping their beer to consumers via Drizly, Minibar, DoorDash, Tavour, Craft Beer Shack, Taprm, Beer Drop, and/or First Sip Brew Box. This worked for some while others focused on getting their state laws changed so they could deliver direct to consumers. These were mostly temporary state law changes and now many craft brewers are working with their state legislators to make the laws permanent.

Craft Brewery Off-Premise Sales in 2021

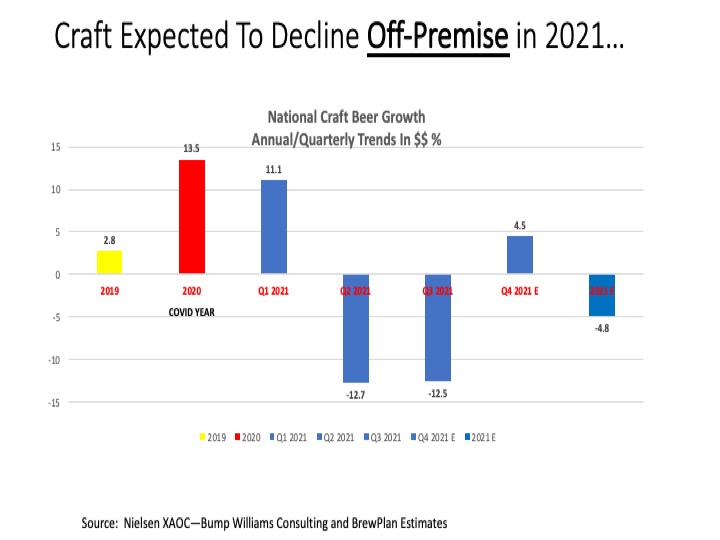

So, what is happening in 2021? By reviewing the off-premise trends shared by the Bump Williams Consulting Group (BWC), the off-premise sales are not growing from 2020 levels when pantry-filling and hoarding became the norm. Here is a chart that shows you what is happening with craft beer by quarter in 2021:

Q2 and Q3 sales for craft brewers have been sluggish in scanned stores; this was caused by some of the largest independent craft breweries not being able to grow their businesses—mainstream craft like Blue Moon and Shocktop suffered the worst declines at -12%

This year the craft brewers are attempting to shore up their on-premise losses from 2020. This has essentially caused a “reverse pivot” in their collective sales strategies by focusing on-premise instead of off-premise. Don’t let the numbers in the above chart fool you—craft will most likely show a small gain of +3-4% once all of the on-premise trends are rolled into the off-premise trends to give the industry a complete picture, which Bart Watson, the economist from the Brewers Association (BA) publishes in late January every year.

Key Factors Affecting Off-Premise Craft Beer Sales in 2021 Include:

- Business closures—Nielsen CGA shows -8% drop in off-premise outlets as a result of COVID.

- Lack of returning restaurant workers causing inconsistent hours of operation and some closures as well.

- Shipping bottlenecks which has impacted aluminum can supply chains causing some out-of-stocks on craft beer.

- Delta Variant which is causing fear about entering off-premise grocery, C-Store and liquor outlets.

- C-stores have been impacted the most as stop-by or walk-in traffic has been curtailed during the Delta Variant.

- Employees who work from home don’t stop at off-premise outlets on their way home from work—they’re making less shopping trips to get groceries and impulse items like snacks and beer!

- Indoor special events, outdoor sporting events and concerts have had less attendees this year than prior years due some event cancellations, dates being moved back and some hesitation from consumers on attending due to fear of getting COVID.

- Travel has somewhat bounced back due to pent-up demand and more safety features but is still down from 2019 levels so this impacts vacations, tourism and business travel.

- Seven in ten working Americans now work from outside the home, which is up +80% from April 2020. Nearly a third of these consumers (31%) are spending more than a hour in their vehicles, causing them to have less time to spend grocery shopping, having household cookouts or spending time watching television with an ice cold beverage or two.

- According to Nielsen CGA survey, consumers who have not gotten or are uncertain about getting their vaccine shots declined from 26% to 17% of all consumers. The 17% are not going to well-traveled off-premise (or on-premise) outlets and some require proof vaccination, so craft beer sales suffer.

- There has been a huge shift in alcohol consumption from weekdays to the weekends. While taprooms used to get consumers 3-4 days per week, the off-premise outlets which captured those consumers only get them one day per week and that’s now on the weekends. Also, consumers are going home earlier from taprooms, so they buy beer-to-go and that creates sales that aren’t tracked by the scanning stores but will be covered when the BA publishes their final numbers for 2021.

Overall, the reverse pivot from on-premise to off-premise has not produced the positive sales results or bounce back, that was expected by the analysts in the craft scanning numbers. We all hope that the return by many consumers to on-premise helps build keg sales, can sales off-site from the taprooms, increase in app-based delivery services, and even direct-to-consumer sales (where legal) provides the volume lift to grow the total craft beer business in 2021 and into 2022!

Learn about UVM’s Business of Craft Beer Certificate Program.

Jon Reynolds is the founder of Brewplan, a strategic marketing advisor to craft brewers, craft distilleries, boutique wineries, and a Certified Instructor in the UVM Business of Craft Beer Professional Certificate Program. He writes about business trends, beer consumers, distributor issues, legislation that affects craft brewers, marketing tools, and strategic planning to improve brewery profits.

Views and opinions expressed herein are those of the author who has spent more than 40+ years in the beer, wine and spirits industry and are provided for informational purposes only. The information set forth reflects the author’s opinion of current trends in the industry and should be researched further to make your own business conclusions.